|

by Justin Metz on January 17, 2022

Retrieved from: https://www.erieinsurance.com/blog/how-to-dig-out-of-snow If you live in an area that regularly sees snow, clearing the driveways and sidewalks after a winter storm is a regular part of life. But when severe winter weather strikes, and the snowfall is measured in feet instead of inches, digging out becomes a lot more work. Even if the weather caught you off guard, you’ll still have to brave the cold and dig your way out. Here are some tips to help you clear away all that ice and snow HOW TO CLEAR SNOW FROM YOUR SIDEWALKS If you own your own home, you are responsible for shoveling sidewalks on your property. In fact, homeowners can be held liable if someone is injured after falling on an obstructed walkway, so it’s important to ensure your sidewalk is cleared. Some places even have laws setting time frames by which snow must be cleared. Expectations vary by state, city and township, so review your local snow removal ordinances to avoid having to brave the cold and pay a fine or receive a citation on top of that. For clearing sidewalks, your options will be limited to a snowblower or shovel. If you’re shoveling, be sure to follow these snow shoveling safety tips to avoid an injury. When you’re finished, add salt or ice melt to the sidewalk to prevent ice buildup. HOW TO REMOVE SNOW FROM YOUR DRIVEWAY After a blizzard, you’ll want to quickly regain access to the street in front of your house. Here are a few options to get the job done: Snow plow While they do sell snow plow attachments for lawn tractors and ATVs, plowing typically isn’t a DIY job for most homeowners. However, hiring a snow plow may not be an option after a big snowstorm. Not only will demand be incredibly high after a blizzard, but really deep snow can become nearly impossible to plow. If you want to hire a snow plow, do it in advance of the storm. Unless a state of emergency has been declared, the plow company will probably come several times during the storm to keep the snow levels more manageable. Snow blower If you don’t have access to a plow, the easiest way to clear your driveway will be using a snow blower. When using a snow blower, start in the middle of your driveway and keep making U-turns to work outward. This allows you to blow snow to both sides of the drive. However, not all snow blowers are created equal. So before you get started, ensure your machine is up to the task.

Snow shovel Using a shovel is obviously the most labor-intensive method of clearing your driveway. However, if you shovel frequently during the snowstorm (instead of waiting until it’s over), you can lessen the amount of snow you need to move each time. You may spend more time shoveling, but it will be easier on your back. Experts also recommend using two types of shovels to clear your drive:

HOW TO DIG YOUR CAR OUT OF THE SNOW If the snow is so deep it’s hard to see your car, you’ve got some work ahead of you. First, clear the space around your vehicle so you’ve got room to work. Then, start from the top and work your way down. Avoid the temptation to use a snow shovel when clearing your car. You’ll risk leaving behind deep scratches in your vehicle’s paint or glass, which could require expensive repairs down the road. Instead, use a foam brush or non-abrasive snow broom to gently clear the snow away. Once you clear enough snow to get into your vehicle, you can start it up and let the defrosters melt any ice on the glass. Just be sure the area around the tailpipe is clear, too. WHAT IF MY CAR GETS STUCK IN THE SNOW? After you dig out your car, resist the urge to step on the gas and spin your wheels. That could put you in an even deeper rut by piling snow and ice around your tires. If you find yourself stuck, the best thing to do is steadily rock your vehicle from front to back. This helps your car gently build momentum to get up and out of the divots. Try carefully switching from drive to reverse. This helps you inch out of the rut by dislodging snow around your tires and creating a clear path to drive out. If that doesn’t work, try these tips:

HOW TO CLEAR SNOW AND ICE FROM YOUR ROOF AND GUTTERS After a blizzard, the extra weight of all that snow and ice could add up to more than your home can bear. Here’s what you need to know about clearing snow and ice from your roof.

HOW TO PREVENT OTHER PROBLEMS CAUSED BY HEAVY SNOW Your roof isn’t the only part of your home that can be damaged by deep snowfall. Be sure to check these other potential problem areas.

BE READY IN ANY WEATHER At Erie Insurance, we’re always here for you – no matter what mother nature throws your way. That’s why it pays to have a local ERIE agent on your side. Talk to us to learn more about auto insurance and home insurance from ERIE.

0 Comments

Retrieved from: https://www.erieinsurance.com/blog/service-line-coverage If you’re like many homeowners, you may have received offers in the mail promoting protection plans for exterior utility lines or pipes. And if you’re like most consumers, you’re not quite sure if this protection is something you might actually need. WHOSE LINE IS IT ANYWAY? The reality is that as a homeowner, exterior underground service and utility lines on your property are often your responsibility – and breaks in a line or accidents during digging can happen. If you need to repair or replace physically damaged lines or pipes, the cost can be substantial. REQUEST A QUOTE In most places, a city, township or utility company will not assume any responsibility for the portion of a service line or pipe that runs underground on your property, to or from the public connection. And typical homeowners insurance policies don’t provide coverage for damage to these exterior underground service lines or pipes, either. This can mean serious trouble for a homeowner if a service line or pipe is physically damaged from a service line failure and requires repair. WHAT SERVICE LINES MIGHT RUN UNDER MY PROPERTY? Exterior underground service and utility lines include:

HOW SERVICE LINES BECOME DAMAGED Some of the most common causes include: tree roots, animal interference, an artificial electrical current, the weight of vehicles pressing down on the lines and even corrosion, rust, wear and tear. Outdoor elements and causes like these can prove detrimental to these service lines and pipes. No matter what the cause, the effects can be costly. Besides repairing the actual service line, a homeowner may have to dig up landscaping, driveways and sidewalks to gain access to the damaged line. Damaged outdoor property like trees, shrubs and even walkways may require repair or replacement as a result of the service line repair or the service line failure itself. GOOD NEWS: HELP FOR HOMEOWNERS If you have an ErieSecure Home® insurance policy, you can purchase additional protection that covers the cost of these service line repairs as well as related excavation costs, outdoor property damage and even loss of use. With ERIE’s Service Line Coverage* as part of your home insurance, you won’t be stuck footing the bill on your own for these service line failures to your exterior underground service lines. WHAT’S COVERED? Service line coverage is available when you add either the Plus or Select bundle to an ErieSecure Home® policy. It provides coverage for physical damage, caused by a covered service line failure, to exterior underground service lines like cable, internet and electrical wiring, and damaged natural gas, propane and sewer pipes.** Talk to us today and we can explain the details and give you a quote on homeowners insurance that includes service line coverage.   Retrieved from: https://rvshare.com/blog/rv-preparation-checklist/ by Dee Montana Last updated on March 26th, 2019 at 04:27 pm. Originally published on July 12th, 2015 One of the first lessons you learn about RVs is that they requires organized and regular maintenance. A simple RV preparation checklist is the perfect way to get your rig ready for it’s first road trip of the season. Some RV owners camp during every season, while others only use their rig in the summer and store it all through the winter months. No matter how or when you use your RV, spring is the perfect time for annual maintenance and systemized checks. Why spring? In most cases, spring weather is a safe time to work on your RV without the fear of a deep freeze. If you stored your RV throughout the winter you probably took certain steps to winterize and prepare your rig for cold storage. If that was the case, the first step in the spring is to reverse this process and gear up for active use. The Basic Preparation Checklist

1. Check the RV batteries Batteries are a great place to start your spring spruce up. Batteries lose up to 10% of their energy per month when in storage and not in use. It’s important to make sure your batteries are fully charged your batteries and have the correct water levels (check your battery manual). If the batteries were removed for storage make sure they are reconnected correctly. Remember! Batteries can be dangerous. Take every precaution, and if you aren’t comfortable messing with them have a service engineer do the process for you. 2. Flush The RV Water Tank, Check for Leaks, and Sanitize You probably winterized your water tanks before putting your RV in storage. Now it’s time to de-winterize and check for any leaks that may have occurred. This process takes a bit of time, but will save you a lot of hassle down the road.

Now it’s time to check for leaks. Grab a flashlight and turn on the water pump. Wait until the sound of the pump stops. Once the water pump stops and the water is pressurized you can turn the pump off and begin your search. Look underneath your sink cabinets, around the toile,t and inside your basement compartments. Anywhere water might flow you want to watch for potential leakage. Take your time with this process. If you locate a leak be sure to have it repaired before you leave on your first trip of the season. This is also a good time to sanitize the water system.

Completing this process will give you peace of mind knowing that your water is clean and fresh every time. 3. Check the RV Appliances If your RV uses propane (Also called LP gas) you need to check the tanks, the connections, the valve and the firing operation. Propane is often used to operate the hot water, the fridge, and the stove. If something isn’t working correctly have your system checked by a professional. Make sure to have a leak test and a gas pressure test each year. You want to be sure that this highly important system is working safely. If you have refillable propane tanks check the dates on the tanks. Most people are unaware that their propane tanks expires and must be re-certified for safety. Check yours annually. Once your propane appliances are in compliance spending some time checking your microwave, air conditioner, fridge or any other electric appliance in your rig. Make sure you plug into a solid source of 30 or 5- amp power. Many people choose to park their RV at an RV park while they test out their systems each spring. 4. Check the RV Tires Tires are a hot topic in the RV industry. Some companies say RV tires should be fully replaced every 5 years. Others claim that if properly cared for they can last 10 years. Either way, you must check your tires to be sure they are ready for the season. Your entire home relies on the safety of these wheels, so give them the attention they deserve. First check the air pressure. While in storage tires loose pressure. Check your manual and fill each tire according to the recommended PSI. Inspect each tire for tread wear and cracking especially in the sidewalls. If you have any concerns, be sure to have a professional inspect the tires prior to leaving on a trip. Don’t let blow out happen to you. Check those tires! 5. Inspect the RV Engine and Generator Now we are ready to tackle the engine! Yup, the all important part that gets you where you want to go deserves some attention too. Start by checking all of the fluid levels and make sure they are full and fresh. If you don’t know what your coach uses look in your owner’s manual or contact your dealer. Here are the fluids you want to check:

If you have low fluids in one area this may indicate a problem or a leak. Take some time to figure out what is happening to the fluid. You will want to service your engine and the fluids on a regular basis. If you have been doing that and you have an issue, be sure to take it in to be looked at before you leave on a trip. Now check all of your gauges. Are they giving accurate readings? Check all your lights. Check the lights on your trailer and the connections between your RV and your trailer. Check your registration, insurance and vehicle emissions sticker. Is everything up to date? If not, stop what you are doing and go get it done! Your generator has been off for a long time and will need to be served according to the manual. Make sure the oil level is correct before you attempt to start the generator. If you didn’t store it correctly, you may have trouble restarting it. Inspect the exhaust area before starting. Do you see any problems? If not, start the generator and plan to let it run for a couple of hours. It doesn’t have to be on full load, but it needs to run for a while to get the engine ready for the season. The last thing you want is to travel without a generator. Take the time to make sure everything is working properly. 6. Check the RV Seams Most people forget about their RV seams. This is a mistake you don’t want to make. Each and every seam has leak potential. If you inspect and reseal the seams one or two times a year you are less likely to have a leak. Start by inspecting the roof and moving down over the body of the rig. Look for any openings, cracks or forms of damage. Is there any separation? Is there a specific area that shows wear? Use RV compatible sealants and research which type of sealant is best for the material you want to repair. If your roof shows wear you may want to consider having it professionally resurfaced and sealed. Ask your local RV dealer for their personal recommendation. If you plan to work on the roof yourself, please be careful. 7. Explore Your Safety With the outside complete, it’s time to move back in the RV. You will want to check the following devices and update their batteries or have the items inspected and recharged

These 7 steps are an essential part of preparing for a safe road trip. Don’t skimp. Take the time to inspect each part of your RV’s system. If you are unable to do the work yourself, book a spring session with a recommended RV technician. If you’re feeling energetic, consider a spring cleaning in the inside of your coach as well. Here are a few things to freshen up:

You may not have time to do every step listed, but this list gives you an idea of what may be needed. Every RV will be different. The key is to set time aside to prepare for the RV season. Don’t wait until the last minute and skimp on your safety. If you’ve completed this simple RV preparation checklist you know you have done everything necessary for a great trip. Retrieved from: https://www.businessinsider.com/personal-finance/why-buy-more-life-insurance-outside-work

Tanza Loudenback Mar 12, 2020, 4:42 PM If you get life insurance for free through work, there's no reason not to take advantage of it. About 60% of non-government workers in the United States have access to life insurance through work. It's a valuable benefit that employers often offer at no cost to employees. Plus, coverage is guaranteed so you don't have to submit to a medical exam. But group coverage still may not be enough, particularly if you have a spouse, kids, or other family members that rely on you for financial support. Here's why you may want to consider buying an individual life insurance policy, too: 1. It's probably not enough coverage Group life insurance is broad and there's no opportunity to customize your policy. Employers typically offer coverage amounts that are a multiple of your salary. According to the Bureau of Labor Statistics, the median worker with access to group life insurance receives $200,000 in coverage. That's a reasonable amount, but anyone with a family to support, debt to pay off, or big future expenses will likely need a larger death benefit. 2. You can't add riders to your policy You also can't add riders to a policy you get through work. Riders are additional terms and conditions that enhance your coverage for specific situations. There are riders that allow you to accelerate the death benefit in the event of illness, get an additional benefit for the death of a spouse or child, or add more coverage for accidental death or dismemberment. 3. You can't take your policy with you Most group life insurance policies aren't portable when you leave your job. While you may have the chance to convert it to an individual policy, you'll have to pay the premiums your employer previously covered. Since a group life policy is guaranteed coverage — there's no evaluation of your health, age, or overall risk to determine your premium — it will likely be more expensive than an individual policy if you're low risk (e.g. you have no major health conditions). 4. You may want a permanent policy Most group life insurance policies are term, meaning they last for a set number of years and then expire. Financial experts often recommend term life insurance for most people because it's affordable and acts as a safety net while you build up your savings, but it's not the only option. If you want to build cash value and/or leave money behind for your spouse, kids, or grandkids, a whole life policy could be a better fit. You may want to consult with a financial planner to see if it's a good option for you. Search Engine Optimization (SEO) is the increasing of web visibility and traffic through organic search engine results. Strong SEO makes your business easier to find online. Although these tips are simple and quick, your SEO will be an ongoing process and it’ll take a while to start seeing the results. A few ways to improve your SEO are by:

Being accurate and consistent Create a document with the following business information:

When filling out information about your business online (mainly on business listings and other web-based profiles), you can copy and paste from the document and it’ll be the same each time. Having the same contact information will make your business seem more reputable to consumers and the search engines. Claiming your business listings Business listings are the results that show up when someone searches for your company online. For Google™, it appears on the right side of the search site. Claiming your listings on search engines like Google, Yelp®, Bing, Yahoo!® and other popular sites will allow you to manage the listings and keep them up-to-date. Improving and updating your website It’s important to have a website, as it acts as your online office for customers to learn about your business and take important actions, like requesting a quote or purchasing a product. If you don’t have a website, you can either hire someone to create one or create one for free using Google My Business. Once you have a website, be sure to keep it updated and free of errors. This could be as simple as improving the loading speed on your website, providing correct information and making sure all links within the site are working correctly. Analyze how your website is doing If you have a Google account, you can register with Google Search Console. It’s free and you can view your website’s performance, page errors, queries and more. You will also get alerted if Google identifies any issues with your website. Staying active on social media At Foremost® we recommend posting on your social media pages three to five times a week. Linking to your website in some of those posts will help drive people to your website and improve your SEO. The more authoritative, real and reliable links you have coming to and from your website, the more this will increase your SEO. Provide quality content Whether you’re creating content for your business’ social media pages, your blog or your website, it should all be high quality and valuable content. For example, having links that are more descriptive than “click here” will also help people navigate your website easier. Potential customers will find interest, more use and learn more about your company. Retrieved from: www.experian.com/blogs/ask-experian/what-is-identity-theft/

By Ben Luthi October 7, 2019 Identity theft is when someone steals your personal information and uses it without your permission. There are several forms of identity theft, and each one can affect you in a different way. There's no way to inoculate yourself against identity theft completely. But if you're diligent in learning how your information can be at risk and what fraudsters can do with it, you'll be better equipped to protect your data and act quickly if someone does manage to steal it. How Identity Theft HappensIdentity theft is a broad term that applies any time someone steals your personal information, such as your Social Security number, and uses it to create a new account, make a purchase or commit other fraud. Due to the nature of technology and the internet, your personal information is always at risk. If you're not carefully monitoring your credit file, you may not notice you've been victimized until the damage is already done. Here are 10 of the most common ways identity thieves get hold of your data: 1. Data BreachesA data breach happens when someone gains access to an organization's data without authorization. The most common types of information stolen in data breaches include full names, Social Security numbers and credit card numbers. In 2018, there were 1,244 data breaches in the U.S., and more than 446 million records were exposed, according to the Identity Theft Resource Center. Because people have so many accounts with various businesses and other organizations, it's virtually impossible to keep your information safe from a data breach, but there are steps you can take to minimize your risk. 2. Unsecure BrowsingFor the most part, you can browse the internet safely, especially if you stick to well-known websites. But if you share any information on an unsecure website or a website that's been compromised by hackers you could be putting your sensitive information directly in the hands of a thief. Depending on your browser, you may get an alert if you try to access a risky website. 3. Dark Web MarketplacesThe dark web is often where your personally identifying information ends up after it's been stolen. Hackers may not necessarily be stealing your information to use it for themselves, but will instead choose to sell it to others who have potentially nefarious intentions. The dark web is a hidden network of websites that aren't accessible by normal browsers. People who visit the dark web use special software to mask their identities and activity, making it a haven for fraudsters. If your information ends up on a dark web marketplace, anybody could buy it, putting your identity in more danger. 4. Malware ActivityMalware is malicious software that's designed to wreak all sorts of havoc. Fraudsters may use malware is to steal your data or spy on your computer activity without you knowing. 5. Credit Card TheftOne of the simplest forms of identity theft is credit card theft. If a thief can gain access to your credit card information, they can use it to make unauthorized purchases. Common ways credit card theft occurs are through a data breach, physical theft, credit card skimmers and via online retail accounts where card information is stored. 6. Mail TheftSince long before the internet, identity thieves have been combing through the mail to find documents that held personal information. Bank and credit card statements and any other document you send or receive through the postal system can be intercepted and used to gain access to your data. The mail you throw away also can leave you vulnerable, so be sure to shred any old mail that may contain personal information. 7. Phishing and Spam AttacksSome scammers use email and text messages and other forms of electronic communication to steal your sensitive information. The message often looks like it's coming from a reputable source and asks victims to give up one or more types of information. For example, a bogus email made to look like it's from your bank may include a link that directs you to a spoof website that looks just like the one it's mimicking. Once there, the website may ask you for a username and password, or to input credit card information or your Social Security number. If something seems suspicious, it might be an attempt at identity theft. 8. Wi-Fi HackingIf you use your computer or phone on a public network—airport, department store or coffee shop Wi-Fi—hackers may be able to "eavesdrop" on your connection. This means that if you type in a password, bank account or credit card number, Social Security number or anything else, an eavesdropper can easily intercept it and use it for their own purposes. 9. Mobile Phone TheftSmartphones are a treasure trove of information for identity thieves, especially if your apps allow you to log in automatically without a password or fingerprint. If someone manages to steal and unlock your phone, it could allow them to view the information found in your apps, as well as in your emails, text messages, notes and more. Make sure your phone locks with a secure passcode, biometric screening is set up properly and your passwords aren't stored in plain text anywhere on your phone. 10. Card SkimmingSome thieves use a skimming device that easily can be placed over a card reader on an ATM or a fuel pump without looking out of the ordinary. When somebody swipes a debit or credit card at a compromised machine, the skimmer reads the information from the card's magnetic stripe and either stores it or transmits it. A criminal can then use this information to make purchases. How Identity Theft Can Affect YouOnce a thief has your information, they can do several things with it, including:

Depending on the type of theft that occurs, and how the criminal uses your information, identity theft can result in immediate financial loss, damage to your credit and emotional distress. It can also take anywhere from less than a day to several months or even years to resolve the issue. As you work on recovering from identity theft, you may end up dealing with late payments, medical bills, and even IRS penalties requiring investigations and long-term assistance if you are a tax identity theft victim. It can also result in losing account access, having your personal accounts taken over by thieves and general loss of data privacy. How to Check for Identity TheftYou can't completely avoid the possibility that your identity may be stolen, but you can take action to spot potential fraud before it becomes a major problem. To check for identity theft, keep an eye on your credit reports. While you can view each one for free every 12 months through AnnualCreditReport.com, you can view a summary of your reports more regularly through various free and paid credit monitoring services. As you check your report, watch for tradelines that you don't recognize or remember opening. Also, keep an eye on your credit score—a sudden inexplicable drop can be a dead giveaway that something is wrong. Here are some other telltale signs that someone may have stolen your identity:

What to Do if You Think You're a VictimIf you have even an inkling that you've fallen victim to identity theft, the most important thing to do is to limit the potential damage. If a credit card or debit card was stolen, contact the card issuer and your bank immediately—some banks may even allow you to lock your account through your mobile app until you can report the fraud. Next, double-check your credit reports with the three credit bureaus (Experian, TransUnion and Equifax) to confirm any type of unusual activity and get help dealing with the theft. If you find something is amiss, consider locking or freezing your credit. Alternatively, you can set up a fraud alert, which notifies lenders that you've been a victim of identity theft so they can take extra measures to verify your identity. Remember, identity theft is a crime, so it's also a good idea to contact your local law enforcement agency. While authorities may not be able to do much, they can take reports and be on the alert for suspicious behavior that could involve your name or address. Before you do report the crime, reach out to the Federal Trade Commission to file a report. The agency will provide steps you need to take and paperwork to file reports—including how to deal with police reports—and help you dispute fraudulent charges. Being a victim of identity theft is a harrowing experience. It can take months and many hours of filling out forms and working with agencies and businesses to recover your identity once it is stolen. Diligence Pays OffRecognizing the signs of identity theft and taking steps to prevent it can save you heartache, stress and loss. As you check your credit report and score regularly, watch out for suspicious transactions, accounts and notifications, and act fast when something is off. If you're diligent, you'll be in a better position to catch identity theft early before it ruins more than just your day. by Justin Metz on October 20, 2020 What do America’s top three best-selling vehicles have in common? They’re all pickup trucks.

It’s no secret that the U.S. has long been a truck-loving nation. But as automakers refine the ride and handling of pickups, more drivers are starting to see them as the jack-of-all-trades. After all, no other vehicle can boast the space and comfort of an SUV with the unmatched towing and cargo-carrying abilities of a truck. But it’s this versatility that makes shopping for a pickup much different—and more difficult—than shopping for a car. So how do you find the truck that’s right for you? Always start with an honest evaluation of how you plan to use your new truck. Then, choose the options that will best meet those needs. WHAT TO LOOK FOR WHEN BUYING A TRUCK Here are some important factors to consider when searching for your perfect truck.

INSURANCE FOR NEW TRUCKS While your new vehicle will lose some of its value the minute you drive it off the lot, that doesn’t mean your insurance coverage should take a hit, too. Ask us about adding the New Auto Security endorsement to your auto quote. If your new car gets totaled, ERIE will pay you the cost to replace it with the newest comparable model year (minus your deductible). (And if you’ve had your car longer than two years, ERIE will pay the cost to replace it with a comparable model that is up to two years newer and up to $30,000 fewer miles than the current mileage of your car, minus the deductible.) Retrieved from: https://www.erieinsurance.com/blog/pickup-truck-buying-guide  by Jenean McLoskey Owning an RV is a wonderful experience – whether you’re a full-timer, a summer traveler or just prefer a weekend getaway, the opportunities for adventure are endless. After all, that’s part of the allure with owning an RV. But, after being in your RV for multiple years, it may need an update! This has drawn many people to renovate their RV DIY style, and if you’re up for the challenge, you can too! Adding some upgrades or changing the interior of your Recreational Vehicle doesn’t mean you need to gut it and start from scratch. There’s many projects you can do that are simple; such as switching out some of the furniture, or adding some décor to make it feel more homey. To help you get started, we put together six customization ideas for your RV if you’re ready for a new and fresh look.

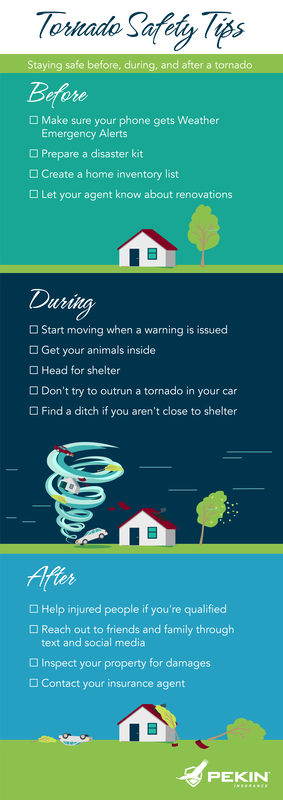

Any upgrade you decide to go with will certainly add that special “touch” you’re looking for. Just make sure you have a clear vision of what you want, a budget and a lot of patience for the project. As always – good luck and safe travels from Foremost®. Retrieved from: https://www.foremost.com/learning-center/custom-upgrades-to-your-rv.asp Retrieved from: https://cover.com/blog/why-did-my-car-insurance-go-up-for-no-reason/ You're a cautious driver – you have no speeding tickets on your driving record and you haven’t recently even hit a parked car in a garage. So, if you have seen your auto insurance premiums increase, you’re probably asking why your car insurance went up for no obvious reason. If you’re feeling frustrated about a premium hike, you’re hardly alone. Data from the Bureau of Labour show that between 2006 and 2016 auto insurance costs increased 50 percent — well above the overall rate of inflation and the increase in new car prices. So why is your car insurance so expensive? You may think changes in your rate are based largely on your own risk factors as a driver. For instance your premium payments can rise following an accident for which you are at fault, or if you receive a ticket for a traffic violation. That’s easy to understand, but there’s a lot more factors that can increase your rate. Beyond being a cautious driver, if you’re safe on the road shouldn’t your premium also be safe from big hikes? Not necessarily. There are many many other factors that can also lead to premium increases. Some are largely beyond your control. Auto insurance is a business, after all. If costs go up for insurers, this can mean higher rates for customers, even those who do everything right on the road. “Auto insurance is heavily regulated, so there is no margin for insurers to absorb increases in costs. So when costs rise, rates rise,” explains James Lynch, chief actuary and VP of research and education with the Insurance Information Institute. Why did my car insurance go up?To help you understand why your rate could go up without an immediately obvious reason why, here are 11 factors that could be pushing your premiums up. 1. Moving house You likely know that auto insurance rates can vary widely by state. But even moving to a different ZIP code just a few miles away can cause your rates to jump. There are many reasons this might happen. You may have moved to an area where the crime rate – including auto theft – is higher. Or there may be more population density in your new area. This means more cars on the road and the higher potential for accidents. Or there simply may be a higher rate of claims in the neighborhood. Moving just a few blocks away to a new home could raise your rates by more than 60 percent, a 2015 Bankrate study found. 2. A Lower Credit Score In most states (currently excluding California, Massachusetts and Hawaii), auto insurers factor in not just your habits on the road but also your credit-worthiness when considering premium rates. As Cover recently reported, 95 percent of auto insurers use credit history in their underwriting decisions. So even if you have a clean driving record, a poor credit score might push up your rates. Shockingly, a low credit score might affect your insurance rates even more than a DUI. Estimates suggest your average annual rate might increase approximately 27 percent if your credit score goes from excellent to fair. If your score drops from excellent to poor your rate could double. Consumer advocates have come out against this practice. It may discriminate against those with lower wealth and education levels, and disproportionately affect minorities. 3. People are Driving More Accidents can drive up your premium rate – even if you’ve never been in one yourself. Economic growth, urban sprawl and low gas prices have people driving more than ever, according to the Federal Highway Administration. And even overall good news can be bad news for your rates. “As the economy improves, people drive more miles,” Lynch says. “The previously unemployed are driving to work, and everyone drives more discretionary miles. This puts more cars on the road at any given time, which increases the chance of an accident.” Lower gas prices may also encourage more frequent driving. The more driving, the more accidents, the more claims – and the more rates can go up across the board. 4. Distracted Drivers More accidents means more potential claims for insurance companies to pay. Accidents have been on the rise in recent years. While hard to draw a direct line of causation, distracted driving is suspected to play a part. Distracted driving has become more prevalent with the rise of smartphone use and internal auto technology – 3,166 people were killed in distracted driving incidents in 2017, according to the National Highway Traffic Safety Administration. “Car consoles have gotten more complex, and more people have smartphones. People have a disturbing tendency to fiddle with both while driving,” Lynch says. “These cause more accidents.” The more accidents, the higher the overall costs for auto insurers. These costs are passed on to all drivers, even those who make sure to avoid distractions while on the road. 5. Uninsured Drivers You’re doing the right thing by having an auto insurance policy. Your rate may go up, however, because not everyone is doing the same. The nationwide rate for drivers without insurance increased from 12.3 percent in 2010 to 13 percent in 2015, according to the Insurance Research Council. Florida has the largest percentage of uninsured motorists at 26.7 percent. Maine has the lowest at 4.5 percent. Dealing with the uninsured claims process can be a massive expense for insurers. Uninsured motorist claims totaled $2.6 billion in 2012, per the IRC. The average cost of an uninsured motorist claim is approximately $20,000. This expense can then be passed on to policyholders. You may also spend more through adding uninsured/underinsured motorist coverage to your policy (some states require this). 6. Higher Speed Limits You may also live in an area that has recently raised its speed limits. This could bump up your auto insurance rate. “A number of states have increased their speed limits, and this leads to an inevitable increase in traffic fatalities,” Lynch says. “More fatalities mean higher liability payments, which puts pressure on rates to rise.” Texas has the country’s single fastest highway with an 85 MPH speed limit. It also has the fastest average allowable speed of 78.3 MPH. 7. Rising Repair Costs The costs for auto repairs are steadily rising, and this can be passed along to the consumer through increased premiums. “Newer cars have more sophisticated warning devices built into bumpers, and they have more gadgets – like automated seats and sound systems,” Lynch says. “When these things get damaged in a car, it costs more to fix the car.” Government regulation has also led to more safety features being added to autos. These increasingly expensive auto parts may not only lead to higher repair costs but also to increased levels of theft with the intent of selling these parts on the black market, according to a report from the National Insurance Crime Bureau. 8. Rising Medical Costs Since people are driving more and more, accidents are on the rise. This causes an increase in how much is paid out by insurance companies for each claim. Rising medical costs is the reason for the steep hike in price for cost per claim, which translates to higher auto insurance premiums. Health care costs are climbing. National health spending is projected to rise at an average annual rate of 5.5 percent from 2017 to 2026, according to the Centers for Medicare and Medicaid Services. Spending will reach $5.7 trillion by that time. Insurance payouts for bodily injury claims grew 6 percent between 2012 and 2017. That’s roughly double the rate of medical inflation. When auto companies have to pay out progressively larger medical costs following at-fault accidents caused by their policyholders, the whole pool of policyholders – even those who have never been at fault – may be affected. 9. Extreme Weather If there has been a significant weather event in your area – hurricane, blizzard, flood – this may affect your auto insurance rate, even if it isn’t right away. Such catastrophes lead to an overall increase in claims in a specific area. Insurance companies are forced to raise rates to make up for that. Across the U.S., there has been increasingly severe weather – from hail storms to flash floods – over the past few years, according to a 2017 report from Farmers Insurance. If such patterns persist, the weather report may increasingly affect your premium. 10. Insurance Fraud You may have never told so much as a white lie to your auto insurance company. But other people’s lies, both large and small, may be adding to your premium rate. Insurance fraud comprises a range of behaviors, which can be seemingly minor (inflating the damages for an accident that did occur) or extreme (completely fabricating or staging an accident). According to Verisk Analytics, automotive insurers lose $29 billion per year in ‘premium leakage’ – missing or erroneous underwriting information that undermines their rating plans. This adds to insurers’ costs and since they want to remain profitable, this can lead to you paying more for your policy. 11. Smoking gun? While this factor will currently affect only an extreme minority of drivers, Lynch says it’s worth noting that, if you live in a state that has recently legalized recreational marijuana use, your premium could see a second-hand effect. “This is only an issue,” he notes, “so far as we know in the states that legalized cannabis for recreational use a couple of years ago [ Colorado, Washington, Oregon], but it is an important one there. Something similar can be expected in states where recreational sales have just begun or are about to begin – Nevada, California, Massachusetts.” In all three states that first legalized marijuana, “the advent of the legal retail sale of marijuana is correlated with increases in collision claim frequency,” according to a 2017 report from the Highway Loss Data Institute.  Retrieved by: http://blog.pekininsurance.com/individual/tornado-season-staying-safe Weather the storm, whether you’re at home or on the go. A thin funnel stretches down from the dark sky. The swirling whirlwind touches the ground and charges ahead. Spring brings sunny days and chirping birds. But it’s the start of tornado season, which peaks in April and lasts through June. Prepare now to stay safe before, during, and after a tornado. Before the Tornado Tornado Watch A tornado watch means the current conditions could lead to a tornado in your area. Move your disaster kit into your shelter room or basement if you don’t store it there. Talk to your wireless carrier about Wireless Emergency Alerts (WEA). With these alerts active on your phone, you'll get a notification when a serious storm is in the area. Disaster Kit Ready.gov says you should keep these items in a disaster kit:

Home Inventory List A tornado could damage your home and the things you own. You don’t want to guess when you report values to your insurance company. Use an app like Sortly or Encircle to create a home inventory list. Or, take pictures with your phone and write details in a notebook. Keep a copy of your home inventory list in a safe location outside your home, and give a second copy to your insurance agent. Home Renovations Have you made recent renovations to your home? This could include finishing the basement, remodeling the kitchen, or updating electrical systems. Report these changes to your insurance agent to keep your homeowners coverage up to date. When you don’t share these updates, you won’t receive the full value of the home in the event of a total loss. During the Tornado Tornado Warning What happens when a tornado has been sighted in your area? A tornado warning is issued, and you should move fast to bring your pets and yourself inside. In Homes Go to the basement, a small interior room, or a hallway on the lowest level. If possible, crouch under a heavy table or staircase. Avoid the corners of the room and stay away from windows. Strong winds can shatter glass and cause bad cuts and other serious injuries. In Mobile Homes A tornado can lift a mobile home and toss it a few miles. That’s because this kind of home isn’t rooted to a foundation. You're better off seeking shelter under a sturdy structure if there's one nearby. Avoid taking cover under trees. If you have nowhere else to go, lie down in a culvert or ditch with your hands protecting your head. In Vehicles Leave your car when a twister breaks out. Try to find shelter or a deep depression in the ground. Don’t stop under a bridge or highway underpass, as these can crumble and create falling debris. Tornadoes move as fast as 60 to 70 mph. They change directions, too, so don’t try to outrun them in your car. In Schools Most schools are big enough to offer reliable shelter from tornadoes. The interior hallways and stairwells offer protection from heavy winds and debris. Debris travels through large spaces like gyms and cafeterias, so try to avoid them. Never go outside to playgrounds or parking lots, and always follow the school's storm safety procedures. The danger increases when you move up in a building. Seek shelter on the lowest level without overcrowding. After the Tornado Making It Through the Aftermath Hopefully, the tornado passes through and does minimal damage to your community. Stay tuned to your local weather channel during this time. You need to know if another storm could show up soon. Check your surroundings, but don’t treat serious injuries if you aren’t qualified. Only administer CPR if you’re trained to do so. After you’re in the clear, reach out to your family and friends through text message or social media. Weather could prevent your calls from going through. You can also register yourself and your family on the American Red Cross Safe and Well site. Inspect Your Property If you’re at home, inspect your property for damages such as:

After you know your family is safe, reach out to your insurance agent to report damages. Don’t wait for a storm to strike. Review your homeowners insurance with your local Pekin Insurance agent, and make sure you have enough coverage. |

Contact Us(740) 927-1469 Archives

August 2023

|

Navigation |

Connect With Us |

Contact Us |

Location |